Warning, borrowing money also costs money.

Finance Your Energy Independence with a Photovoltaic Panel Loan

With the continuous rise in energy prices, a photovoltaic panel loan is a sustainable solution to lower your energy bills. Despite the removal of some regional grants, this loan allows you to finance a particularly advantageous long-term investment. Produce your own electricity and take back control of your budget.

Simulate your solar loanLegal Notice

** A loan commits you and must be repaid. Check your repayment capabilities before committing. The rates indicated are for information purposes only and subject to approval of your application.

The Photovoltaic Loan: Your Key to Self-Consumption

The Photovoltaic Panel Loan is a purpose-specific loan tailored to finance your solar project. It covers your entire installation, allowing you to produce your own electricity. As a purpose-specific loan, the funds are exclusively released for this precise use, which often guarantees you more favorable financing conditions than a standard personal loan.

What equipment can you finance with a Photovoltaic Loan?

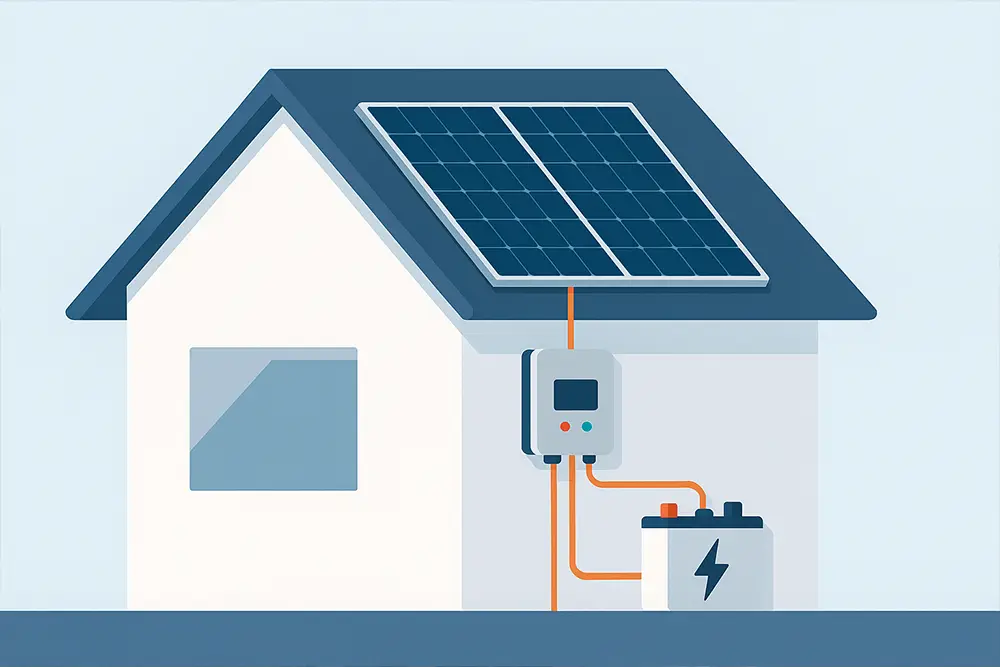

- Photovoltaic solar panels: The heart of your system for capturing the sun’s energy.

- The inverter: The essential device that converts direct current (DC) from the panels into alternating current (AC) for your home.

- The home battery: To store surplus energy produced during the day for use in the evening or on cloudy days.

- The mounting system and wiring: The entire structure and connections needed for the installation.

- Qualified labor: The cost of installation by a certified professional.

- Optional: an electric vehicle charging station, if it’s integrated into the solar project.

Our online simulator helps you bring your energy independence project to life:

- Calculate the amount to borrow for a complete installation.

- Set a monthly payment that fits your budget and is covered by your future savings.

- Choose the ideal term to comfortably pay off your investment.

Investing in solar means choosing a more autonomous and economical future. The Photovoltaic Loan makes this strategic investment accessible today.

Free • No obligation • Quick initial response

The Key Benefits of a Solar Loan

Opting for a Photovoltaic Loan is a wise choice that combines financial profitability, autonomy, and a positive action for the planet:

-

Attractive interest rate: As a “green” loan, it often benefits from a lower APR (Annual Percentage Rate) than a personal loan, as banks support investments in renewable energy.

-

Immediate reduction in your bills: As soon as it’s installed, you produce and consume your own electricity. The savings can cover a large portion of your monthly payments.

-

Increased property value: A home with energy autonomy and an excellent energy performance rating is a major asset that increases its market value.

-

A profitable investment even without grants: Faced with volatile energy prices, the profitability of a solar installation no longer depends on subsidies. The loan allows you to seize this opportunity without delay.

The Photovoltaic Loan is not just an expense; it’s a strategic investment in your energy independence and financial control.

How to finance your solar installation in 5 steps?

Our process is simple and fast to help you bring your self-consumption project to life.

1. Online Simulation

Use our simulator to estimate the amount and term of your solar loan. Get a clear view of your monthly payment.

2. Application and Quote

Fill out the application form and attach the detailed quote from your photovoltaic panel installer.

3. Analysis and Offer

Our experts analyze your file and the project’s compliance. You’ll receive a personalized contract offer as quickly as possible.

4. Contract Signing

After accepting our offer, you sign the contract, often electronically for maximum simplicity.

5. Payment to the Installer

Upon presentation of the final installation invoice, the funds are transferred to the company or to your account so you can pay it.

Our advisors specializing in solar financing are by your side to guide you at every step.

Flexible Financing for Your Solar Project

The Photovoltaic Loan is designed to adapt to the nature of your project and your financial situation:

-

Fixed and secure rate: Most solar loans have a fixed rate. Your monthly payments will never increase, giving you perfect visibility of the total cost of your installation.

-

Adapted repayment term: Choose a repayment term that allows you to align the loan’s amortization with the lifespan of your panels and the energy savings generated.

-

A loan 100% tied to your project: As a purpose-specific loan, it protects you. If the installation is canceled, the loan can be too. You will need to provide the installer’s quote and invoices to release the funds.

-

Early repayment possible: The law allows you to repay your loan before the end of the term. The savings from your bills can help you speed up this repayment.

This structure provides you with transparent, secure financing that is perfectly aligned with your investment in solar energy.

An Investment for Your Wallet and for the Planet

A well-structured Photovoltaic Loan is your best ally for a serene and profitable energy future.

Calculate your return on investment

Compare your future monthly payment to the estimated electricity savings. You’ll quickly see how your installation “pays for itself” over the years.

Maximize your self-consumption

Our advisors can help you size your loan to include a battery, thus maximizing the use of your free electricity, day and night.

Benefit from our expertise

We analyze your project and situation to offer you the most suitable financing solution, ensuring the coherence of your investment and your budget.

By investing in your own electricity production, you act against rising prices and for the environment, while building a more solid asset.

Testimonials: They produce their own electricity

“With soaring prices, we really wanted to switch to solar. The loan allowed us to finance not only the panels but also a storage battery. Our monthly bills have already dropped drastically. We are much more at ease now!”

“For the installation of my photovoltaic panels, the process was very smooth. The simulation was accurate, and the funds were released without any issues upon presentation of the installer’s invoice. I produce my own electricity, which is a great satisfaction.”

What our clients appreciate most:

- The simplicity of the process, from simulation to payment of the installer.

- The competitive rates that make the project profitable more quickly.

- The support for a complete project, including the battery.

The Photovoltaic Loan transforms a significant initial cost into a controlled and quickly profitable monthly investment.

Photovoltaic Loan FAQ

Find answers here to frequently asked questions about financing your solar installation. This loan is the ideal solution to become a producer of your own electricity.

It is a purpose-specific installment loan, exclusively intended for financing a solar installation. It is designed to cover all costs related to your project:

- The solar panels themselves.

- The inverter (which converts the current).

- A possible storage battery for increased autonomy.

- Installation costs by a professional.

The fact that it is “purpose-specific” means you must provide a quote and an invoice, which secures the transaction and often allows for a better interest rate.

Yes, more than ever. The profitability of a solar installation today depends mainly on two factors:

- The high price of electricity: Every kWh you produce and consume is a kWh you don’t buy from the grid. The higher the price of electricity, the greater your savings and the faster your installation pays for itself.

- The cost of installations: The price of panels has dropped considerably in recent years, making the initial investment more accessible.

The photovoltaic loan is precisely there to allow you to make this initial investment without waiting, and to start saving immediately. The monthly savings made contribute directly to repaying your loan.

Yes, it is even strongly recommended. Including a home battery in your project and your loan is an excellent strategy. A battery allows you to store the surplus electricity produced during the day (when the sun is shining) to use it in the evening and at night.

This maximizes your self-consumption rate, i.e., the share of your electricity that you produce yourself. By financing the battery with the panels, you optimize your installation for maximum energy independence from day one.

In addition to the usual documents for a loan application (ID card, proof of income), the key document for a photovoltaic loan is the detailed and signed quote from your installer.

This quote must clearly state:

- The type and number of panels.

- The make and model of the inverter.

- Details of any battery.

- The cost of labor and materials.

For the final release of funds, the corresponding invoice will also be required. This procedure ensures that the funds are used for the intended project.

The photovoltaic loan, as a “green” purpose-specific loan, has two major advantages over a personal loan:

- A Lower Interest Rate (APR): This is the main financial benefit. Lenders encourage green investments by offering more attractive rates, which reduces the total cost of your loan.

- Increased Security: The loan is directly linked to the contract with your installer. If, for any reason, the installation is canceled, the loan agreement can also be canceled (subject to conditions). With a personal loan, you receive a sum of money for which you are liable, whether the project goes ahead or not.

For a 100% solar project, the purpose-specific loan is therefore the safest and most economical solution.

The release of funds is conditional on proof that the work has been completed. The process is simple and secure:

- You sign the loan agreement.

- The installer carries out the work.

- They provide you with the final invoice.

- You forward this invoice to us.

- We transfer the funds either directly to the installer’s account or to your own account so that you can pay them immediately.

This method ensures that payment is only made once the service has been rendered, thus protecting you throughout the process.