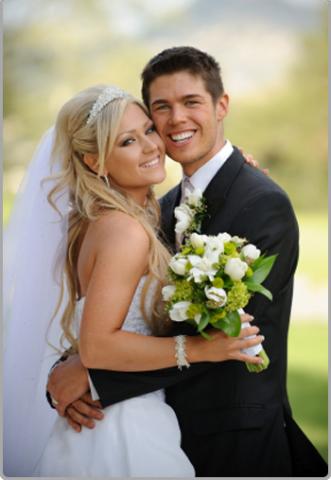

The fulfillment and success of a couple are often measured by the partners’ ability to conceive, undertake, and succeed in joint projects. This inclination is nothing surprising as it simply translates into action the desire of two people to look in the same direction.

The fulfillment and success of a couple are often measured by the partners’ ability to conceive, undertake, and succeed in joint projects. This inclination is nothing surprising as it simply translates into action the desire of two people to look in the same direction.

Buying a property, having children, starting a business are all projects that can strengthen and consolidate the bonds between two people. Even though it is far from indispensable and often outdated in certain social circles, organizing a wedding is still one of those symbolic events that some couples love to achieve together.

Organizing a wedding is different from the other projects mentioned above because it is primarily an act of sharing. Indeed, when two people unite, either civilly or religiously, they primarily want to give a certain form of publicity and commitment to their union. In other words, it is about publicly formalizing the happiness that exists between two people. In this case, the presence of family and friends allows the lovers to share this happiness with their loved ones.

This is why weddings remain extremely popular and symbolic for millions of people.

Organizing a wedding is no small feat. On the contrary, this joyous event requires vision, organization, method, preparation, and financing. To make this day a complete success, you will need to seriously build a project and execute it meticulously.

Essential elements

It is generally accepted that the serene organization of a wedding requires one year. Here are some basic keys that will help you start thinking about organizing your wedding.

Take the time to reflect…

Do not rush headlong into organizing a wedding. Spend a weekend together in a quiet place and take the time to ask yourself the right questions such as:

- Do you want to marry religiously or only civilly?

- Will the civil and religious ceremonies take place on the same day or on different days?

- Do you prefer a discreet and intimate wedding or do you want to invite many of your friends and family?

- Classic ceremony (reception, catering, dance party) or more minimalist (walking dinner with friends in a garden)?

- Do you plan to go on a honeymoon the day after your wedding or later?

- Where will you invest your money? The meal, the religious ceremony, the civil wedding, the dance party, your honeymoon…?

- Etc.

Plan to gather information from the town hall first!

Depending on the availability of your town hall and the administrative procedures, you will have a clearer idea of how much time you will need to organize your wedding. Start by asking questions at the marriage service of your town hall.

Inquire with the priest or pastor of the parish of your choice

Finding the right parish is far from as simple as one might imagine. Many couples plan to marry in popular parishes, and often the wait can be long. It is not uncommon for some priests to refuse their parish because you are not domiciled in the area of their parish or town. Similarly, availabilities are not always obvious. Think about it at least a year in advance, and remember, you will need to align the availability date of your parish with the availability of the caterer, the ceremony hall, and sometimes even with your town’s vacation. Being clear: planning ahead is essential.

Book your caterer and reception hall

Here too, you will need to consider booking nearly a year in advance, especially if you hope to marry during the most favorable times of the year for this happy event. In general, most weddings are booked between April and September. You will not be alone in desiring a particular date, location, church…

Having your wedding dress made

Is not only a pleasure but can also be a long process, especially if you want your dress to be custom-made or if you plan to design it yourself: a conception period of 6 months is not uncommon.

Take advice

Take advice

Do not hesitate to listen to the advice of your friends: they represent good guarantees. Some will recommend a good caterer, a good hall, the right priest. There are also many websites specialized in wedding planning, consult them.

Some couples hire the services of a wedding planner or master of ceremonies. These are small luxuries that can be essential for those who would have difficulties conceiving and executing such a large-scale project on their own. You will also find on our website, the basics of organizing your wedding. Take the time to read these tips.

The time invested in reading these preliminary recommendations will quickly pay off by avoiding mistakes.

Financing and budget of your wedding

What does a wedding cost? What budget should be considered?

All this will depend on your wishes and ambitions.

Renting a reception hall costs around 2,000€.

The cost of a wedding banquet is around 60€ per guest.

Let’s assume that the budget for a wedding ranges from 10,000 to 40,000€ for the most expensive ones (not including the honeymoon, of course).

Do not forget to plan and count everything.

Additionally, you can get discounts if:

- You organize your wedding during less busy periods (between September and March). For this reason, renting a hall in January will be much cheaper than in July.

- Some halls offer a complete package of services: reception hall, caterer, dance party. This bundled formula will undoubtedly be cheaper than if you opt for a caterer or DJ of your choice.

- Providing your wedding meal as well as your own wines can also be a winning formula.

Our credit company offers special conditions to finance your wedding. For wedding loans, we automatically offer you our lowest APR rates on the market. It is our way of giving you a beautiful wedding gift.

As you can see, a considerable number of parameters need to be considered. That is why a year is not an unnecessary luxury to successfully carry out what will undoubtedly be an unforgettable day for you, your family, your friends, and all your loved ones.

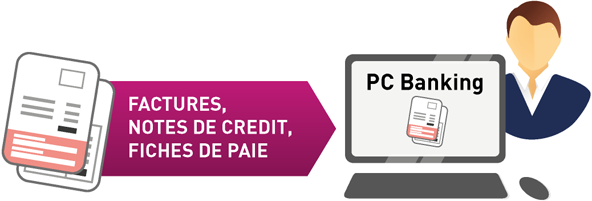

First, the banking union in Europe is taking shape with the standardization of account numbers for banking service users (BIC Code). As a result, transactions are processed more quickly and securely throughout the European Union. This standardization has a significant economic impact as the speed of transactions saves time for users while maintaining an optimal level of security.

First, the banking union in Europe is taking shape with the standardization of account numbers for banking service users (BIC Code). As a result, transactions are processed more quickly and securely throughout the European Union. This standardization has a significant economic impact as the speed of transactions saves time for users while maintaining an optimal level of security.

Our company has become the official sponsor of the

Our company has become the official sponsor of the  The fulfillment and success of a couple are often measured by the partners’ ability to conceive, undertake, and succeed in joint projects. This inclination is nothing surprising as it simply translates into action the desire of two people to look in the same direction.

The fulfillment and success of a couple are often measured by the partners’ ability to conceive, undertake, and succeed in joint projects. This inclination is nothing surprising as it simply translates into action the desire of two people to look in the same direction. Take advice

Take advice

Generally, it is the aesthetic or mechanical side of the machine that attracts the beginner who wishes to acquire a motorcycle. However, many criteria must be taken into account to combine road pleasure and savings.

Generally, it is the aesthetic or mechanical side of the machine that attracts the beginner who wishes to acquire a motorcycle. However, many criteria must be taken into account to combine road pleasure and savings.