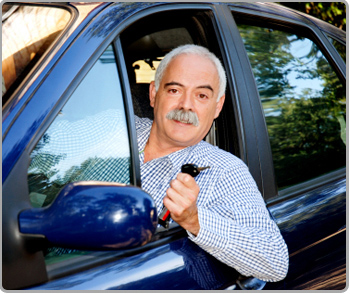

Today, February 17th, marks the start of the practical test of the highly controversial kilometer-based tax project by the government.

In practice, 1,200 people will start testing the kilometer-based tax this Monday, which involves paying up to 9 cents per kilometer traveled within the RER zone (Brussels, its periphery, and areas covered by the future regional express network), versus 5 cents on the highway and 6.5 on other roads.

The rate varies depending on the time of travel and the characteristics of the vehicle. After a month of training, the actual test will last for one month. The results are expected in mid-May.

This is indeed a test. No decision has been made by the different regional governments. An article from the Crédit Populaire Européen

In brief

Driving in urban areas could cost 9 cents per kilometer in the future, compared to 5 cents on the highway and 6.5 cents on other roads. The principle provides for a car tax on each kilometer traveled, depending on peak hours and the type of road used by the driver.

The tax will be more expensive during peak hours – from 7 a.m. to 9 a.m. and from 4 p.m. to 6 p.m. – and motorists can drive for free between 10 p.m. and 5 a.m. During peak hours, the amount will reach 9 cents per kilometer in urban areas.

The fee calculation will be done using a GPS that will calculate the distances traveled. Its implementation would be facilitated today by the GPS systems that will be installed from 2015 on all new cars to enable the installation of the European automatic emergency call system.

The device’s screen displays the vehicle’s location as well as the price of the road being used.

The potential implementation of this kilometer-based tax, which will be tested for two months, will not be possible before 2017.

A project that is not new

This project originated from an agreement concluded in 2011 between the three Regions regarding the taxation of heavy goods vehicles. The idea had been in the air for about ten years.

The consultant PwC proposed this idea, and it was presented on behalf of car importers by the Fébiac last October.

The “polluter pays” principle

The principle is logical and already applied through excise duties on fuels, VAT, maintenance, and spare parts, or new insurance formulas: the more you drive, the more you pay.

This project is supported by Beci, Voka, Touring, and VAB and aims to introduce car taxation based on usage rather than ownership. It is intended to replace existing taxes and the flat-rate circulation tax.

Other objectives: to encourage drivers to use public transport more often or to plan their trips at less congested times, which are more tax-advantageous. One of the main objectives is to find a solution to the congestion of urban centers and specifically to traffic jams in Brussels.

A contested project…

Public opinion reacts quite negatively. Comments are popping up everywhere on social media, and a petition against the kilometer tax is currently collecting nearly 167,000 signatures.

Opponents see it as discriminatory taxation that would primarily hit those who drive many kilometers a year and live far from urban centers. In itself, this consequence is logical, but its Achilles’ heel is that it would seem to mainly affect low-income individuals who chose to buy their house a bit further away to reduce the purchase price. This is a significant adverse effect.

As a result, many politicians, and indeed the vast majority of political parties, say they are opposed to this project. It must be said that the prospect of upcoming elections does not encourage politicians to take risks.

But in absolute terms… encouraging motorists to drive less is a project that also has its reasons for being.

Did you know?

A new car loan applies a more advantageous APR than the financing of a used car. A car is considered new when it is less than three years old. Thus, you can obtain very competitive financing on a used car that is less than 3 years old. Get your free simulation with our online credit simulator

The crisis that has been raging in Europe since 2008 does not only have bad sides. Since European governments have tackled public deficits, a panel of austerity measures has been implemented by member states to try to generate more tax revenue to replenish state coffers.

The crisis that has been raging in Europe since 2008 does not only have bad sides. Since European governments have tackled public deficits, a panel of austerity measures has been implemented by member states to try to generate more tax revenue to replenish state coffers. First, the banking union in Europe is taking shape with the standardization of account numbers for banking service users (BIC Code). As a result, transactions are processed more quickly and securely throughout the European Union. This standardization has a significant economic impact as the speed of transactions saves time for users while maintaining an optimal level of security.

First, the banking union in Europe is taking shape with the standardization of account numbers for banking service users (BIC Code). As a result, transactions are processed more quickly and securely throughout the European Union. This standardization has a significant economic impact as the speed of transactions saves time for users while maintaining an optimal level of security.

Do you want to apply for a loan, an installment loan, a personal loan, or a mortgage?

Do you want to apply for a loan, an installment loan, a personal loan, or a mortgage?